Educational Robot Market Size, Share, Industry Growth Analysis Report by Type (Humanoid Robots, Collaborative Industrial Robots), Component (Sensors, End Effectors, Actuators, Controllers), Education Level (Higher Education, Special Education) - Global Growth Driver and Industry Forecast to 2027

Updated on : March 06, 2025

The educational robot market size is experiencing significant growth as the demand for innovative learning tools rises across schools, universities, and at-home learning environments. Key trends driving this growth include the increasing integration of AI and machine learning into educational robots, making them more interactive and adaptive to individual learning needs. Additionally, the rise of coding and robotics competitions is fueling interest in these technologies among students and educators alike. Looking to the future, the educational robot market is poised to expand further with advancements in personalized learning, gamification, and immersive experiences. As technology evolves and educational institutions continue to seek innovative ways to engage students, the demand for educational robots is expected to grow, transforming how education is delivered in classrooms and beyond.

Educational Robot Market Size & Share

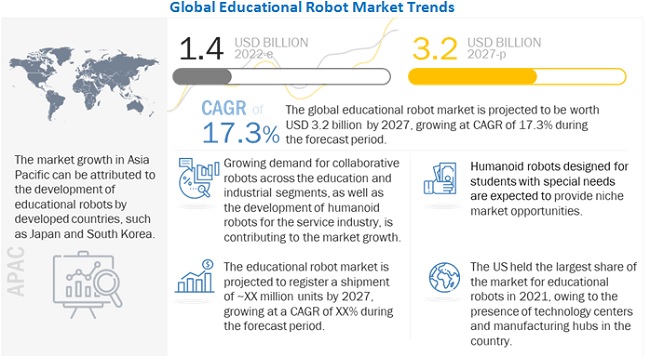

The global educational robot market size in terms of revenue was estimated to be worth USD 1.4 billion in 2022 and is poised to reach USD 3.2 billion by 2027, growing at a CAGR of 17.3% from 2022 to 2027. The new research study consists of an industry trend analysis of the market.

The increasing usage of robots in manufacturing, which is creating new job opportunities, is promoting the expansion of this sector. Also, the service industry is changing due to the growing development of humanoid robots, which is also causing the market for educational robots to grow.

To know about the assumptions considered for the study, Request for Free Sample Report

Educational Robot Market Dynamics

DRIVERS : Surging demand for collaborative robots in education and industrial sectors

Collaborative robots are becoming more affordable and are easier to program, especially for novice users. They are used in two distinct ways in research and education. Universities are studying how to utilize the potential of collaborative robots across several different industries by uncovering new uses and applications, improving existing applications, enhancing robot efficiency, and studying robots’ effects on health and occupational safety in the workplace. For instance, several universities around the world are studying the use of collaborative robots for various medical procedures in assisting doctors and surgeons. On the other hand, universities and community colleges are deploying robots to teach students the skills and technologies required to enter the workforce. In the US, universities such as Johns Hopkins, The University of Maryland, Virginia Tech, Marshall University, and others have dedicated collaborative robot education centers that expose students to collaborative robots and offer robotics research opportunities.

RESTRAINT: High costs associated with educational robots

Most of the robots used for training and education have a payload of around 10 kg or less. In some instances, robots with higher payloads up to 60 kg are also used. The cost of industrial robots, coupled with integration costs and the cost of peripherals, such as end effectors and vision systems, makes industrial robots a costly investment for educational institutions. Humanoid robots can cost anywhere from USD 7,000 to USD 50,000. For instance, the TIAGo humanoid robot from PAL Robotics (Spain) costs around USD 50,000. The high cost of humanoid robots used for education and training purpose restrain the growth of educational robots industry.

OPPORTUNITIES : Introduction of industrial robots in high schools

There has been a rise in the number of secondary schools around the world that offer robotics classes and related disciplines to prepare students for industries being transformed by robotic automation. The schools are adapting educational materials developed by industrial robot manufacturers and building special labs. The idea is to give the students a foundation on industrial technology’s workings and, in some cases, expose them to careers in the automated manufacturing industry. For instance, ABB has 6 affiliate colleges in the US for industrial robotics education, namely, Motlow State Community College, Jefferson State Community College, Vincennes University, Robotics Technology Park, Fox Valley Technical College, and Piedmont Technical College.

CHALLENGES: Difficulties faced by training centers to conduct hands-on training

The installation, commissioning, and training of industrial robots require human resources. The pandemic control measures undertaken worldwide are making hands-on training difficult to conduct. Many of the training programs are being conducted online, and robot simulation software is being leveraged. However, they do not provide the benefits of a real-world operating scenario. Hence, institutions and training centers are unable to provide a hands-on training approach during this pandemic.

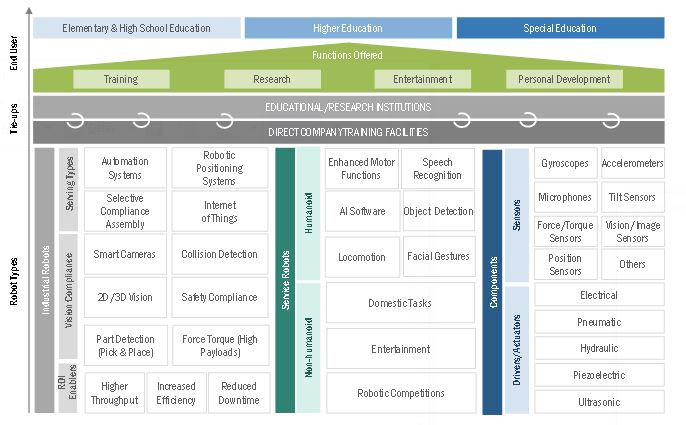

Educational Robot Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Service robots to hold the larger share of educational robot market during forecasted period

Service robots are mostly adopted in the special education segment for children having special needs, especially for children diagnosed with autism. These service robots are mostly of humanoid type that tries to bridge the communication gap between a student and teacher. With robots, children with autism can gain skills and knowledge through alternative methods. More interactive and digital educational content is required for integrating with interactive devices in the educational segment. For instance, the Pepper robot from SoftBank Robotics Group (Japan) has a touchscreen display on its chest that can be programmed to display various educational content. The Sanbot Elf and the Sanbot Max robots from Sanbot Innovation (China) also have touchscreens mounted to the robot.

Elementary and high school education expected to hold the second largest share in education robot market in 2021

Humanoid robots in elementary school can serve as customized instructors for individuals or groups, engage with students to enhance social and emotional skills, and keep detailed data on their interactions so teachers can track student development. Such social robots are meant to promote interaction between children and robots by positioning themselves as learning assistant that engages kids in educational activities. They can also be programmed to interact in multiple languages to help kids learn a second language. For high school education, programmable robots are utilized that help student enhance their coding skills as well as allow students to customize robots and build them for robotics competitions and events.

Asia Pacific is expected to hold the second largest market of educational robot during forecasted period

Asia Pacific is expected to adopt educational robots at a fast rate driven by government initiatives for advancing education in the region. Additionally, technological advancements in the field of robotics made by the regional players further provide opportunities for introducing educational robots into the study curriculum. Japan and South Korea are making relentless strides in the development of various types of robots. Hence, it is expected that Asia Pacific will surpass the market in North America for educational robots during the forecast period.

Top Educational Robot Companies - Key Market Players

The educational robot companies is dominated by a few globally established players such as

- ABB Ltd. (Switzerland),

- FANUC Corporation (Japan),

- YASKAWA Electric (Japan),

- KUKA (Germany),

- Universal Robots (Denmark),

- SoftBank Robotics Group (Japan),

- Hanson Robotics (China),

- ROBOTIS (South Korea),

- Robolink (US), UBTECH Robotics (China), among others.

Educational Robot Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 1.4 Billion |

| Projected Market Size | USD 3.2 Billion |

| Growth Rate | 17.3% CAGR |

|

Market size availability for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/Billion) and Volume (Thousand Units) |

|

Segments covered |

|

|

Region Covered |

|

|

Companies covered |

|

| Key Market Driver | Surging demand for collaborative robots in education and industrial sectors |

| Key Market Opportunity | Introduction of industrial robots in high schools |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Service robots |

The study categorizes the educational robot market based on component, type, educational level, and region at the global level.

Global Educational Robot Market Segmentation

Educational Robot Market Size, By Type

-

Service Robot

- Humanoid

- Non-humnoid

- Industrial Robot

Educational Robot Market Share, By Component

-

Hardware

- Robotics Arms

- End Effectors

- Actuators/Drives

- Controllers

- Sensors

- Power Source System

- Others

- Software

Educational Robot Industry, By Educational Level

- Elementary and High School Education

- Higher Education

- Special Education

Educational Robot Market, By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

- Middle East & Africa

- South America

Recent Developments in Educational Robot Industry

- In March 2022, FANUC launched the new CRX-5iA, CRX-20iA/L, and CRX-25iA collaborative robots, the latest additions to its popular CRX series that includes the CRX-10iA and CRX-10iA/L collaborative robots. This launch will strengthen the business in the European market and offers a wide range of applications including inspection, machine load/unload, packing, palletizing, sanding, welding, training, and others.

- In November 2021, ABB entered into a partnership with Sevensense Robotics AG to offer next-generation autonomous mobile robots. This partnership aims to offer customers high levels of flexibility as mobile robots would be able to navigate autonomously in dynamic indoor and outdoor environments.

- In October 2021, SoftBank Robotics has signed a Master Distribution agreement with United Robotics Group (URG), a subsidiary of the RAG-Stiftung in Essen for sales, services, and maintenance of Pepper & NAO robots in Europe

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the educational robot market during forecasted?

The global educational robot market is forecasted to reach USD 3.2 billion in 2027, growing at a CAGR of 17.3% from 2022–2027. This growth attributed by the surging demand of industrial robots for higher education in various universities.

What are some of the technology trends of educational robot market?

The recent trends of the educational robot market include Artificial Intelligence (AI), big data analytics, Industrial Internet of Things (IIoT), and Multi-purpose Cobots.

What hardware components are covered in educational robot market?

The hardware of educational robots include robotic arms, end effectors, sensors, drivers/actuators, power source systems, controllers, and others, which include body materials and other electrical, electronic, and mechanical components.

Who are the winners in the global educational robot market?

ABB Ltd. (Switzerland), KUKA (Germany), FANUC (Japan), YASKAWA (Japan), and Universal Robots (Japan), fall under the winner category in the educational robot market.

Which region will lead the educational robot market in the future?

Asia Pacific is expected to lead the educational robot market during the forecast period. Owing to increasing penetration of industrial robots in various industries, and government initiatives for modernizing the education sector and technological advancements are expected to boost the market for educational robots in this region. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 EDUCATIONAL ROBOT MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED

1.4 CURRENCY AND PRICING

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 2 EDUCATIONAL ROBOT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 EDUCATIONAL ROBOT MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE)— REVENUES GENERATED FROM SALES OF EDUCATIONAL ROBOTS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE)—ILLUSTRATION OF REVENUE ESTIMATIONS OF ONE COMPANY IN EDUCATIONAL ROBOT MARKET

FIGURE 6 MARKET: TOP-DOWN APPROACH

2.2.3 MARKET PROJECTIONS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 37)

3.1 REALISTIC SCENARIO

3.2 OPTIMISTIC SCENARIO

3.3 PESSIMISTIC SCENARIO

FIGURE 8 EDUCATIONAL ROBOT MARKET SIZE : GROWTH PROJECTION BY ADOPTING REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

FIGURE 9 SERVICE ROBOTS TO HOLD LARGER SHARE OF MARKET IN 2022

FIGURE 10 HARDWARE COMPONENT TO HOLD LARGER SHARE OF MARKET IN 2027

FIGURE 11 MARKET FOR SPECIAL EDUCATION TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 12 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2022

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE OPPORTUNITIES IN EDUCATIONAL ROBOT MARKET

FIGURE 13 DEVELOPMENT OF HUMANOID AND COLLABORATIVE ROBOTS DRIVING GROWTH OF MARKET

4.2 EDUCATIONAL ROBOT MARKET, BY TYPE

FIGURE 14 SERVICE ROBOTS TO HOLD LARGER SHARE OF MARKET DURING FORECAST PERIOD

4.3 MARKET, BY COMPONENT

FIGURE 15 MARKET FOR SOFTWARE COMPONENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

4.4 MARKET IN NORTH AMERICA, BY TYPE VS. BY COUNTRY

FIGURE 16 SERVICE ROBOTS AND US TO BE LARGEST SHAREHOLDERS OF MARKET IN NORTH AMERICA IN 2022

4.5 MARKET, BY EDUCATION LEVEL

FIGURE 17 MARKET SIZE FOR SPECIAL EDUCATION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.6 EDUCATIONAL ROBOT MARKET, BY REGION

FIGURE 18 ASIA PACIFIC EXPECTED TO HOLD LARGEST SHARE OF MARKET IN 2027

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 GROWING DEMAND FOR COLLABORATIVE ROBOTS IN EDUCATION AND INDUSTRIAL SECTORS IS MAJOR DRIVER FOR MARKET

5.2.1 DRIVERS

FIGURE 20 IMPACT OF DRIVERS ON EDUCATIONAL ROBOT MARKET

5.2.1.1 Increasing deployment of robots in manufacturing industries to promote new job opportunities

5.2.1.2 Surging demand for collaborative robots in education and industrial sectors

5.2.1.3 Growing research and developments related to humanoid robots to transform service sector

5.2.2 RESTRAINTS

FIGURE 21 IMPACT OF RESTRAINTS ON EDUCATIONAL ROBOT MARKET

5.2.2.1 High costs associated with educational robots

5.2.3 OPPORTUNITIES

FIGURE 22 IMPACT OF OPPORTUNITIES ON EDUCATIONAL ROBOT INDUSTRY

5.2.3.1 Introduction of industrial robots in high schools

TABLE 1 LIST OF UNIVERSITIES OFFERING COURSES ON INDUSTRIAL ROBOTS

5.2.3.2 Designing humanoid robots for students with special needs

5.2.4 CHALLENGES

FIGURE 23 IMPACT OF CHALLENGES ON EDUCATIONAL ROBOT MARKET

5.2.4.1 Lack of interoperability standards in robotic industry

5.2.4.2 Difficulties faced by training centers to conduct hands-on training

5.3 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS OF EDUCATIONAL ROBOT ECOSYSTEM: R&D AND MANUFACTURING PHASES CONTRIBUTE MAXIMUM VALUE

5.4 ECOSYSTEM/MARKET MAP

FIGURE 25 EDUCATIONAL ROBOT ECOSYSTEM

5.4.1 EDUCATIONAL ROBOT OEMS

TABLE 2 OEMS OF EDUCATIONAL ROBOTS

5.4.2 SUPPLIERS

5.4.3 ROBOT INTEGRATORS

5.4.4 DISTRIBUTORS

5.4.5 IT/BIG DATA COMPANIES

5.4.6 SOFTWARE SOLUTIONS PROVIDERS

5.4.7 RESEARCH CENTERS

5.5 PRICE ANALYSIS

TABLE 3 AVERAGE SELLING PRICE OF VARIOUS EDUCATIONAL ROBOTS

TABLE 4 AVERAGE SELLING PRICE OF TELEPRESENCE ROBOTS (NON-HUMANOID ROBOTS), BY LEVEL

5.6 TECHNOLOGY ANALYSIS

5.6.1 KEY TECHNOLOGIES AND TRENDS

5.6.1.1 Integration of vision systems with industrial robots

5.6.1.2 Growing commercial use of humanoid robots

5.6.2 COMPLEMENTARY TECHNOLOGIES

5.6.2.1 Penetration of IIoT and AI in industrial manufacturing

5.6.2.2 Integration of AI with robots

5.6.2.3 Research on standard OS for robots

5.6.3 ADJACENT TECHNOLOGY

5.6.3.1 Penetration of 5G in industrial manufacturing

5.7 PORTER’S FIVE FORCES MODEL

TABLE 5 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8 CASE STUDIES

5.8.1 MOTLOW COLLEGE BECOMES ABB ROBOTICS EDUCATION AFFILIATE

5.8.2 MADISON COLLEGE STUDENTS GAIN FIRST PLACE IN INDUSTRIAL ROBOTICS COMPETITION

5.8.3 UNIVERSITY OF TORONTO ACQUIRED SIX KUKA ROBOTS

5.8.4 TALOS HUMANOID ROBOT INTRODUCED AT UNIVERSITY OF EDINBURGH

5.8.5 TALOS HUMANOID ROBOT INTRODUCED AT UNIVERSITY OF WATERLOO

5.9 TRADE DATA

5.9.1 IMPORT SCENARIO

5.9.1.1 Import scenario of industrial robots

TABLE 6 IMPORTS OF INDUSTRIAL ROBOTS, 2017–2021 (USD MILLION)

5.9.2 EXPORT SCENARIO

5.9.2.1 Export scenario of industrial robots

TABLE 7 EXPORTS OF INDUSTRIAL ROBOTS, 2017–2021 (USD MILLION)

5.10 PATENT ANALYSIS

TABLE 8 PATENTS FILED FOR VARIOUS TYPES OF INDUSTRIAL AND SERVICE ROBOTS

5.11 TARIFFS

TABLE 9 MFN TARIFFS FOR INDUSTRIAL ROBOTS EXPORTED BY US

TABLE 10 MFN TARIFFS RATES FOR INDUSTRIAL ROBOTS EXPORTED BY CHINA

5.11.1 POSITIVE IMPACT OF TARIFFS ON EDUCATIONAL ROBOTS

5.11.2 NEGATIVE IMPACT OF TARIFFS ON EDUCATIONAL ROBOTS

5.12 REGULATIONS

5.12.1 NORTH AMERICA

5.12.2 EUROPE

5.12.3 ASIA PACIFIC

6 EDUCATIONAL ROBOT MARKET, BY TYPE (Page No. - 67)

6.1 INTRODUCTION

TABLE 11 EDUCATIONAL ROBOT MARKET, BY TYPE, 2018–2021 (USD MILLION)

FIGURE 26 SERVICE ROBOTS TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

TABLE 12 EDUCATIONAL ROBOT INDUSTRY, BY TYPE, 2022–2027 (USD MILLION)

TABLE 13 MARKET, BY TYPE, 2018–2021 (THOUSAND UNITS)

TABLE 14 MARKET, BY TYPE, 2022–2027 (THOUSAND UNITS)

6.2 SERVICE ROBOTS

TABLE 15 MARKET FOR SERVICE ROBOTS, BY TYPE, 2018–2021 (USD MILLION)

FIGURE 27 HUMANOID ROBOTS TO GROW EXPERIENCE HIGHER CAGR DURING FORECAST PERIOD

TABLE 16 MARKET FOR SERVICE ROBOTS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 17 MARKET FOR SERVICE ROBOTS, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 18 MARKET FOR SERVICE ROBOTS, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 19 MARKET FOR SERVICE ROBOTS, BY HARDWARE TYPE, 2018–2021 (USD MILLION)

TABLE 20 MARKET FOR SERVICE ROBOTS, BY HARDWARE TYPE, 2022–2027 (USD MILLION)

TABLE 21 MARKET FOR SERVICE ROBOTS, BY EDUCATION LEVEL, 2018–2021 (USD MILLION)

TABLE 22 EDUCATIONAL ROBOT MARKET FOR SERVICE ROBOTS, BY EDUCATION LEVEL, 2022–2027 (USD MILLION)

TABLE 23 MARKET FOR SERVICE ROBOTS, BY REGION, 2018–2021 (USD MILLION)

TABLE 24 MARKET FOR SERVICE ROBOTS, BY REGION, 2022–2027 (USD MILLION)

TABLE 25 MARKET FOR SERVICE ROBOTS IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 26 MARKET FOR SERVICE ROBOTS IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 27 MARKET FOR SERVICE ROBOTS IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 28 MARKET FOR SERVICE ROBOTS IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 29 MARKET FOR SERVICE ROBOTS IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 30 EDUCATIONAL ROBOT MARKET FOR SERVICE ROBOTS IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 31 MARKET FOR SERVICE ROBOTS IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 32 MARKET FOR SERVICE ROBOTS IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 33 MARKET FOR SERVICE ROBOTS IN SOUTH AMERICA, BY COUNTRY/REGION, 2018–2021 (USD MILLION)

TABLE 34 MARKET FOR SERVICE ROBOTS IN SOUTH AMERICA, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

6.2.1 HUMANOID ROBOTS

6.2.1.1 Humanoid robots are most complex type of service robots

TABLE 35 EDUCATIONAL ROBOT MARKET SIZE FOR HUMANOID ROBOTS, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 36 MARKET FOR HUMANOID ROBOTS, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 37 MARKET FOR HUMANOID ROBOTS, BY HARDWARE TYPE, 2018–2021 (USD MILLION)

TABLE 38 MARKET FOR HUMANOID ROBOTS, BY HARDWARE TYPE, 2022–2027 (USD MILLION)

TABLE 39 MARKET FOR HUMANOID ROBOTS, BY EDUCATION LEVEL, 2018–2021 (USD MILLION)

TABLE 40 EDUCATIONAL ROBOT MARKET FOR HUMANOID ROBOTS, BY EDUCATION LEVEL, 2022–2027 (USD MILLION)

TABLE 41 MARKET FOR HUMANOID ROBOTS, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 MARKET FOR HUMANOID ROBOTS, BY REGION, 2022–2027 (USD MILLION)

6.2.2 NON-HUMANOID ROBOTS

6.2.2.1 Non-humanoid robots offer greater computer-aided creativity compared to humanoid robots

TABLE 43 MARKET FOR NON-HUMANOID ROBOTS, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 44 MARKET FOR NON-HUMANOID ROBOTS, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 45 MARKET FOR NON-HUMANOID ROBOTS, BY HARDWARE TYPE, 2018–2021 (USD MILLION)

TABLE 46 MARKET FOR NON-HUMANOID ROBOTS, BY HARDWARE TYPE, 2022–2027 (USD MILLION)

TABLE 47 MARKET FOR NON-HUMANOID ROBOTS, BY EDUCATION LEVEL, 2018–2021 (USD MILLION)

TABLE 48 MARKET SIZE FOR NON-HUMANOID ROBOTS, BY EDUCATION LEVEL, 2022–2027 (USD MILLION)

TABLE 49 MARKET FOR NON-HUMANOID ROBOTS, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 MARKET FOR NON-HUMANOID ROBOTS, BY REGION, 2022–2027 (USD MILLION)

6.3 INDUSTRIAL ROBOTS

6.3.1 ROBOT MANUFACTURERS OFFER LOW-PAYLOAD INDUSTRIAL ROBOTS FOR EDUCATIONAL USE

TABLE 51 MARKET FOR INDUSTRIAL ROBOTS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 52 MARKET FOR INDUSTRIAL ROBOTS, BY TYPE, 2022–2027 (USD MILLION)

TABLE 53 MARKET FOR INDUSTRIAL ROBOTS, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 54 EDUCATIONAL ROBOT MARKET FOR INDUSTRIAL ROBOTS, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 55 MARKET FOR INDUSTRIAL ROBOTS, BY HARDWARE TYPE, 2018–2021 (USD MILLION)

TABLE 56 MARKET FOR INDUSTRIAL ROBOTS, BY HARDWARE TYPE, 2022–2027 (USD MILLION)

TABLE 57 MARKET FOR INDUSTRIAL ROBOTS, BY EDUCATION LEVEL, 2018–2021 (USD MILLION)

TABLE 58 MARKET FOR INDUSTRIAL ROBOTS, BY EDUCATION LEVEL, 2022–2027 (USD MILLION)

TABLE 59 MARKET FOR INDUSTRIAL ROBOTS, BY REGION, 2018–2021 (USD MILLION)

TABLE 60 MARKET FOR INDUSTRIAL ROBOTS, BY REGION, 2022–2027 (USD MILLION)

TABLE 61 MARKET FOR INDUSTRIAL ROBOTS IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 62 MARKET FOR INDUSTRIAL ROBOTS IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 63 MARKET SIZE FOR INDUSTRIAL ROBOTS IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 64 MARKET FOR INDUSTRIAL ROBOTS IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 65 MARKET FOR INDUSTRIAL ROBOTS IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 66 MARKET FOR INDUSTRIAL ROBOTS IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 67 MARKET FOR INDUSTRIAL ROBOTS IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 68 MARKET FOR INDUSTRIAL ROBOTS IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 69 MARKET FOR INDUSTRIAL ROBOTS IN SOUTH AMERICA, BY COUNTRY/REGION, 2018–2021 (USD THOUSAND)

TABLE 70 MARKET FOR INDUSTRIAL ROBOTS IN SOUTH AMERICA, BY COUNTRY/REGION, 2022–2027 (USD THOUSAND)

TABLE 71 MARKET FOR TRADITIONAL INDUSTRIAL ROBOTS, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 72 MARKET FOR TRADITIONAL INDUSTRIAL ROBOTS, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 73 EDUCATIONAL ROBOT MARKET FOR TRADITIONAL INDUSTRIAL ROBOTS, BY HARDWARE TYPE, 2018–2021 (USD MILLION)

TABLE 74 MARKET FOR TRADITIONAL INDUSTRIAL ROBOTS, BY HARDWARE TYPE, 2022–2027 (USD MILLION)

TABLE 75 MARKET FOR TRADITIONAL INDUSTRIAL ROBOTS, BY EDUCATION LEVEL, 2018–2021 (USD MILLION)

TABLE 76 MARKET FOR TRADITIONAL INDUSTRIAL ROBOTS, BY EDUCATION LEVEL, 2022–2027 (USD MILLION)

TABLE 77 MARKET FOR TRADITIONAL INDUSTRIAL ROBOTS, BY REGION, 2018–2021 (USD MILLION)

TABLE 78 MARKET FOR TRADITIONAL INDUSTRIAL ROBOTS, BY REGION, 2022–2027 (USD MILLION)

TABLE 79 MARKET FOR COLLABORATIVE INDUSTRIAL ROBOTS, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 80 MARKET FOR COLLABORATIVE INDUSTRIAL ROBOTS, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 81 MARKET FOR COLLABORATIVE INDUSTRIAL ROBOTS, BY HARDWARE TYPE, 2018–2021 (USD THOUSAND)

TABLE 82 MARKET FOR COLLABORATIVE INDUSTRIAL ROBOTS, BY HARDWARE TYPE, 2022–2027 (USD THOUSAND)

TABLE 83 MARKET FOR COLLABORATIVE INDUSTRIAL ROBOTS, BY EDUCATION LEVEL, 2018–2021 (USD MILLION)

TABLE 84 EDUCATIONAL ROBOT MARKET FOR COLLABORATIVE INDUSTRIAL ROBOTS, BY EDUCATION LEVEL, 2022–2027 (USD MILLION)

TABLE 85 MARKET FOR COLLABORATIVE INDUSTRIAL ROBOTS, BY REGION, 2018–2021 (USD THOUSAND)

TABLE 86 MARKET FOR COLLABORATIVE INDUSTRIAL ROBOTS, BY REGION, 2022–2027 (USD THOUSAND)

6.4 IMPACT OF COVID-19 ON EDUCATIONAL ROBOT TYPES

7 EDUCATIONAL ROBOT MARKET, BY COMPONENT (Page No. - 99)

7.1 INTRODUCTION

FIGURE 28 SOFTWARE TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

TABLE 87 EDUCATIONAL ROBOT MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 88 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

7.2 HARDWARE

TABLE 89 MARKET, BY HARDWARE COMPONENT, 2018–2021 (USD MILLION)

TABLE 90 MARKET, BY HARDWARE COMPONENT, 2022–2027 (USD MILLION)

TABLE 91 MARKET FOR HARDWARE COMPONENT, BY TYPE, 2018–2021 (USD MILLION)

TABLE 92 MARKET FOR HARDWARE COMPONENT, BY TYPE, 2022–2027 (USD MILLION)

7.2.1 ROBOTIC ARMS

7.2.1.1 Industrial robots consist of multi-linked arms having six to seven axes

7.2.2 END EFFECTORS

7.2.2.1 End effectors are integral part of any industrial robot

7.2.3 ACTUATORS/DRIVES

TABLE 93 EDUCATIONAL ROBOT MARKET FOR ACTUATORS/DRIVES, BY TYPE, 2018–2021 (USD MILLION)

TABLE 94 MARKET FOR ACTUATORS/DRIVES, BY TYPE, 2022–2027 (USD MILLION)

7.2.3.1 Electrical

7.2.3.1.1 Electrical actuators are much more efficient compared to hydraulic actuators

7.2.3.2 Pneumatic

7.2.3.2.1 Pneumatic actuators convert electric energy into mechanical energy

7.2.3.3 Hydraulic

7.2.3.3.1 Hydraulic actuators are used where heavy forces and high speed are required

7.2.3.4 Piezoelectric

7.2.3.4.1 Piezoelectric actuators use converse piezoelectric effect for operation

7.2.3.5 Ultrasonic

7.2.3.5.1 Ultrasonic actuators are used to control vibrations, positioning applications, and quick switching

7.2.4 CONTROL SYSTEMS/CONTROLLERS

7.2.4.1 Controllers allow all parts of robot to operate together

TABLE 95 EDUCATIONAL ROBOT MARKET FOR CONTROL SYSTEMS/CONTROLLERS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 96 MARKET FOR CONTROL SYSTEMS/CONTROLLERS, BY TYPE, 2022–2027 (USD MILLION)

7.2.5 SENSORS

TABLE 97 MARKET FOR SENSORS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 98 MARKET FOR SENSORS, BY TYPE, 2022–2027 (USD MILLION)

7.2.5.1 Gyroscopes

7.2.5.1.1 Gyroscopes are used to sense angular velocity in three dimensions

7.2.5.2 Microphones

7.2.5.2.1 Microphone arrays are used for speech and speaker recognition applications in educational robots

7.2.5.3 Accelerometers

7.2.5.3.1 Accelerometers can sense wide range of non-gravitational acceleration forces

7.2.5.4 Tilt sensors

7.2.5.4.1 Tilt sensors can measure tilt angle with ground plane reference

7.2.5.5 Force/torque sensors

7.2.5.5.1 Force/torque sensors are mainly used in collaborative robots to detect collisions

7.2.5.6 Position sensors

7.2.5.6.1 Position sensors measure distance traveled by a robotic system from its reference position

7.2.5.7 Vision/image sensors

7.2.5.7.1 CMOS sensors are widely used in cameras and vision systems

7.2.5.8 Others

7.2.6 POWER SOURCE SYSTEMS

7.2.6.1 Service robots mainly use batteries to operate

TABLE 99 EDUCATIONAL ROBOT MARKET FOR POWER SOURCE SYSTEMS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 100 MARKET FOR POWER SOURCE SYSTEMS, BY TYPE, 2022–2027 (USD MILLION)

7.2.7 OTHERS

TABLE 101 MARKET FOR OTHERS, BY TYPE, 2018–2021 (USD MILLION)

TABLE 102 MARKET FOR OTHERS, BY TYPE, 2022–2027 (USD MILLION)

7.3 SOFTWARE

7.3.1 SOFTWARE IS DESIGNED USING CODED COMMANDS SO THAT ROBOTS CAN CARRY OUT SPECIFIC TASKS

TABLE 103 MARKET FOR SOFTWARE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 104 MARKET FOR SOFTWARE, BY TYPE, 2022–2027 (USD MILLION)

8 EDUCATIONAL ROBOT MARKET, BY EDUCATION LEVEL (Page No. - 113)

8.1 INTRODUCTION

TABLE 105 EDUCATIONAL ROBOT MARKET , BY EDUCATION LEVEL, 2018–2021 (USD MILLION)

FIGURE 29 MARKET FOR HIGHER EDUCATION TO HOLD LARGEST SIZE DURING FORECAST PERIOD

TABLE 106 MARKET, BY EDUCATION LEVEL, 2022–2027 (USD MILLION)

TABLE 107 MARKET, BY EDUCATION LEVEL, 2018–2021 (THOUSAND UNITS)

TABLE 108 MARKET, BY EDUCATION LEVEL, 2022–2027 (THOUSAND UNITS)

8.2 ELEMENTARY AND HIGH SCHOOL EDUCATION

8.2.1 HUMANOID ROBOTS ARE WIDELY USED AS LEARNING ASSISTANTS AT ELEMENTARY SCHOOL LEVEL

TABLE 109 SCHOOLS ADOPTING VARIOUS EDUCATIONAL ROBOTS

TABLE 110 MARKET FOR ELEMENTARY & HIGH SCHOOL EDUCATION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 111 MARKET FOR ELEMENTARY & HIGH SCHOOL EDUCATION, BY TYPE, 2022–2027 (USD MILLION)

8.3 HIGHER EDUCATION

8.3.1 SERVICE ROBOTS ARE EXTENSIVELY USED IN HIGHER EDUCATION

TABLE 112 MARKET FOR HIGHER EDUCATION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 113 MARKET FOR HIGHER EDUCATION, BY TYPE, 2022–2027 (USD MILLION)

8.4 SPECIAL EDUCATION

8.4.1 EDUCATIONAL ROBOTS ARE MOSTLY ADOPTED FOR SPECIAL EDUCATION TO PROVIDE UNIQUE AND INTERACTIVE SOLUTIONS FOR CHILDREN

TABLE 114 MARKET FOR SPECIAL EDUCATION, BY TYPE, 2018–2021 (USD MILLION)

TABLE 115 MARKET FOR SPECIAL EDUCATION, BY TYPE, 2022–2027 (USD MILLION)

9 EDUCATIONAL ROBOT MARKET, BY REGION (Page No. - 120)

9.1 INTRODUCTION

FIGURE 30 ASIA PACIFIC TO WITNESS HIGHEST GROWTH IN EDUCATIONAL ROBOT MARKET DURING FORECAST PERIOD

TABLE 116 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 117 MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 118 MARKET, BY REGION, 2018–2021 (THOUSAND UNITS)

TABLE 119 MARKET FOR, BY REGION, 2022–2027 (THOUSAND UNITS)

9.2 NORTH AMERICA

FIGURE 31 NORTH AMERICA: SNAPSHOT OF EDUCATIONAL ROBOT MARKET

TABLE 120 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 121 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 122 MARKET IN NORTH AMERICA, BY TYPE, 2018–2021 (USD MILLION)

TABLE 123 MARKET IN NORTH AMERICA, BY TYPE, 2022–2027 (USD MILLION)

9.2.1 US

9.2.1.1 US held largest share of educational robot market in 2020

TABLE 124 EDUCATIONAL INSTITUTIONS ADOPTING VARIOUS EDUCATIONAL ROBOTS IN US

9.2.2 CANADA

9.2.2.1 AI research to support growth of educational robot market in Canada during forecast period

TABLE 125 EDUCATIONAL INSTITUTIONS ADOPTING VARIOUS EDUCATIONAL ROBOTS IN CANADA

9.2.3 MEXICO

9.2.3.1 Mexico is expected to be fastest-growing market for educational robots in North America during forecast period

TABLE 126 EDUCATIONAL INSTITUTIONS ADOPTING VARIOUS EDUCATIONAL ROBOTS IN MEXICO

9.3 EUROPE

FIGURE 32 EUROPE: SNAPSHOT OF EDUCATIONAL ROBOT MARKET

TABLE 127 MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 128 MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 129 MARKET IN EUROPE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 130 MARKET IN EUROPE, BY TYPE, 2022–2027 (USD MILLION)

9.3.1 UK

9.3.1.1 Presence of several institutions in UK offering education degrees in robotics in Europe to favor market growth

TABLE 131 EDUCATIONAL INSTITUTIONS ADOPTING VARIOUS EDUCATIONAL ROBOTS IN UK

9.3.2 GERMANY

9.3.2.1 Extensive research in robotics fosters market growth in Germany

TABLE 132 EDUCATIONAL INSTITUTIONS ADOPTING VARIOUS EDUCATIONAL ROBOTS IN GERMANY

9.3.3 FRANCE

9.3.3.1 Government initiatives boost deployment of educational robots in France

TABLE 133 EDUCATIONAL INSTITUTIONS ADOPTING VARIOUS EDUCATIONAL ROBOTS IN FRANCE

9.3.4 ITALY

9.3.4.1 Presence of various groups of educational organizations related to robots in Italy promotes market growth

TABLE 134 EDUCATIONAL INSTITUTIONS ADOPTING VARIOUS EDUCATIONAL ROBOTS IN ITALY

9.3.5 REST OF EUROPE

9.4 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: SNAPSHOT OF EDUCATIONAL ROBOT MARKET

TABLE 135 EDUCATIONAL ROBOT MARKET IN ASIA PACIFIC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 136 MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 137 MARKET IN ASIA PACIFIC, BY TYPE, 2018–2021 (USD MILLION)

TABLE 138 MARKET IN ASIA PACIFIC, BY TYPE, 2022–2027 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Increased level of automation across manufacturing and service sectors to drive market growth

TABLE 139 EDUCATIONAL INSTITUTIONS ADOPTING VARIOUS EDUCATIONAL ROBOTS IN CHINA

9.4.2 JAPAN

9.4.2.1 Deployment of English-speaking robots in schools to favor market growth

TABLE 140 EDUCATIONAL INSTITUTIONS ADOPTING VARIOUS EDUCATIONAL ROBOTS IN JAPAN

9.4.3 SOUTH KOREA

9.4.3.1 Concentration of robotics companies propels market

TABLE 141 EDUCATIONAL INSTITUTIONS ADOPTING VARIOUS EDUCATIONAL ROBOTS IN SOUTH KOREA

9.4.4 INDIA

9.4.4.1 India to be fastest-growing market for educational robots in Asia Pacific during forecast period

TABLE 142 EDUCATIONAL INSTITUTIONS ADOPTING VARIOUS EDUCATIONAL ROBOTS IN INDIA

9.4.5 TAIWAN

9.4.5.1 Ongoing R&D on humanoid robots in universities in Taiwan to catalyze market growth

TABLE 143 EDUCATIONAL INSTITUTIONS ADOPTING VARIOUS EDUCATIONAL ROBOTS IN TAIWAN

9.4.6 REST OF ASIA PACIFIC

9.5 ROW

TABLE 144 MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 145 MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

TABLE 146 MARKET IN ROW, BY TYPE, 2018–2021 (USD MILLION)

TABLE 147 MARKET IN ROW, BY TYPE, 2022–2027 (USD MILLION)

9.5.1 MIDDLE EAST & AFRICA

9.5.1.1 Market in Middle East & Africa primarily driven by modernization of school curriculums

9.5.2 SOUTH AMERICA

TABLE 148 MARKET IN SOUTH AMERICA, BY COUNTRY/REGION, 2018–2021 (USD MILLION)

TABLE 149 MARKET IN SOUTH AMERICA, BY COUNTRY/REGION, 2022–2027 (USD MILLION)

9.5.2.1 Brazil

9.5.2.1.1 Brazil expected to lead development of educational robots in South America

TABLE 150 EDUCATIONAL INSTITUTIONS ADOPTING VARIOUS EDUCATIONAL ROBOTS IN BRAZIL

9.5.2.2 Rest of South America

9.6 IMPACT OF COVID-19 ON EDUCATIONAL ROBOT MARKET IN VARIOUS REGIONS

10 COMPETITIVE LANDSCAPE (Page No. - 142)

10.1 OVERVIEW

10.2 MARKET EVALUATION FRAMEWORK

TABLE 151 OVERVIEW OF STRATEGIES DEPLOYED BY EDUCATIONAL ROBOT COMPANIES

10.2.1 PRODUCT PORTFOLIO

10.2.2 REGIONAL FOCUS

10.2.3 MANUFACTURING FOOTPRINT

10.2.4 ORGANIC/INORGANIC PLAY

10.3 MARKET SHARE ANALYSIS: EDUCATIONAL ROBOT MARKET, 2021

TABLE 152 SHARE OF LEADING COMPANIES IN EDUCATIONAL ROBOTS MARKET, 2021

10.4 5-YEAR COMPANY REVENUE ANALYSIS

FIGURE 34 5-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN MARKET

10.5 COMPANY EVALUATION QUADRANT

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 35 EDUCATIONAL ROBOT COMPANY EVALUATION QUADRANT, 2021

10.5.5 COMPANY FOOTPRINT

TABLE 153 COMPANY PRODUCT FOOTPRINT

TABLE 154 COMPANY APPLICATION FOOTPRINT

TABLE 155 COMPANY INDUSTRY FOOTPRINT

TABLE 156 COMPANY REGION FOOTPRINT

10.6 START-UP/SME EVALUATION MATRIX

TABLE 157 LIST OF START-UP COMPANIES IN MARKET

10.6.1 PROGRESSIVE COMPANIES

10.6.2 RESPONSIVE COMPANIES

10.6.3 DYNAMIC COMPANIES

10.6.4 STARTING BLOCKS

FIGURE 36 EDUCATIONAL ROBOT MARKET, START-UP/SME EVALUATION MATRIX, 2021

10.7 COMPETITIVE SITUATIONS AND TRENDS

10.7.1 PRODUCT LAUNCHES

TABLE 158 PRODUCT LAUNCHES, APRIL 2019–2022

10.7.2 ACQUISITIONS, PARTNERSHIPS, COLLABORATIONS, AGREEMENTS, & JOINT VENTURES

TABLE 159 ACQUISITIONS, PARTNERSHIPS, COLLABORATIONS, AGREEMENTS, & JOINT VENTURES, 2019-2021

10.7.3 CONTRACTS AND EXPANSIONS

TABLE 160 CONTRACTS AND EXPANSIONS, 2019–2021

11 COMPANY PROFILES (Page No. - 161)

11.1 KEY PLAYERS

(Business Overview, Hardware, software, and services, Recent Developments, MnM View)*

11.1.1 ABB

TABLE 161 ABB: BUSINESS OVERVIEW

FIGURE 37 ABB: COMPANY SNAPSHOT

11.1.2 YASKAWA

TABLE 162 YASKAWA ELECTRIC: BUSINESS OVERVIEW

FIGURE 38 YASKAWA: COMPANY SNAPSHOT

11.1.3 FANUC

TABLE 163 FANUC: BUSINESS OVERVIEW

FIGURE 39 FANUC: COMPANY SNAPSHOT

11.1.4 KUKA

TABLE 164 KUKA: COMPANY SNAPSHOT

FIGURE 40 KUKA: COMPANY SNAPSHOT

11.1.5 UNIVERSAL ROBOTS

TABLE 165 UNIVERSAL ROBOT: COMPANY OVERVIEW

11.1.6 SOFTBANK ROBOTICS GROUP

TABLE 166 SOFTBANK ROBOTICS: BUSINESS OVERVIEW

11.1.7 ROBOTIS

TABLE 167 ROBOTIS: BUSINESS OVERVIEW

11.1.8 PAL ROBOTICS

TABLE 168 PAL ROBOTICS: BUSINESS OVERVIEW

11.1.9 UBTECH ROBOTICS

TABLE 169 UBTECH ROBOTICS: BUSINESS OVERVIEW

11.1.10 HANSON ROBOTICS

TABLE 170 HANSON ROBOTICS: BUSINESS OVERVIEW

*Details on Business Overview, Hardware, software, and services, Recent Developments, MnM View might not be captured in case of unlisted companies.

11.2 OTHER KEY PLAYERS

11.2.1 SEIKO EPSON

11.2.2 HYULIM ROBOT

11.2.3 PROBOTICS AMERICA

11.2.4 AISOY ROBOTICS

11.2.5 SANBOT INNOVATION

11.2.6 TECHMAN ROBOT

11.2.7 DJI

11.2.8 WONDER WORKSHOP

11.2.9 PITSCO

11.2.10 ROBOLINK

11.2.11 ROBOTERRA

12 ADJACENT AND RELATED MARKETS (Page No. - 200)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 COLLABORATIVE ROBOT MARKET, BY COMPONENT

TABLE 171 COLLABORATIVE ROBOT MARKET, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 172 COLLABORATIVE ROBOT MARKET, BY COMPONENT, 2021–2027 (USD MILLION)

12.3.1 HARDWARE

TABLE 173 COLLABORATIVE ROBOT MARKET FOR HARDWARE, BY HARDWARE, 2017–2020 (USD MILLION)

TABLE 174 COLLABORATIVE ROBOT MARKET FOR HARDWARE, BY HARDWARE, 2021–2027 (USD MILLION)

12.3.2 SOFTWARE

12.4 COLLABORATIVE ROBOT MARKET, BY INDUSTRY

TABLE 175 COLLABORATIVE ROBOT MARKET SIZE, BY INDUSTRY, 2017–2020 (USD MILLION)

TABLE 176 COLLABORATIVE ROBOT MARKET SIZE, BY INDUSTRY, 2021–2027 (USD MILLION)

TABLE 177 COLLABORATIVE ROBOT MARKET SIZE, BY INDUSTRY, 2017–2020 (UNITS)

TABLE 178 COLLABORATIVE ROBOT MARKET SIZE, BY INDUSTRY, 2021–2027 (UNITS)

12.4.1 AUTOMOTIVE

12.4.1.1 Collaborative robots are being used to perform light and repetitive tasks

TABLE 179 COLLABORATIVE ROBOT MARKET SIZE FOR AUTOMOTIVE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 180 COLLABORATIVE ROBOT MARKET SIZE FOR AUTOMOTIVE INDUSTRY, BY REGION, 2021–2027 (USD MILLION)

12.4.2 ELECTRONICS

12.4.2.1 Collaborative robots can handle small and fragile components in electronics industry

TABLE 181 COLLABORATIVE ROBOT MARKET SIZE FOR ELECTRONICS INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 182 COLLABORATIVE ROBOT MARKET SIZE FOR ELECTRONICS INDUSTRY, BY REGION, 2021–2027 (USD MILLION)

12.4.3 METALS & MACHINING

12.4.3.1 Collaborative robots are used along with CNC and other heavy machinery to automate various tasks

TABLE 183 COLLABORATIVE ROBOT MARKET SIZE FOR METALS & MACHINING INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 184 COLLABORATIVE ROBOT MARKET SIZE FOR METALS & MACHINING INDUSTRY, BY REGION, 2021–2027 (USD MILLION)

12.4.4 PLASTICS & POLYMERS

12.4.4.1 Collaborative robots are deployed along with injection and blow molding machines

TABLE 185 COLLABORATIVE ROBOT MARKET SIZE FOR PLASTICS & POLYMERS INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 186 COLLABORATIVE ROBOT MARKET SIZE FOR PLASTICS & POLYMERS INDUSTRY, BY REGION, 2021–2027 (USD MILLION)

12.4.5 FOOD & BEVERAGES

12.4.5.1 Collaborative robots are used in food industry for both primary and secondary handling applications

TABLE 187 COLLABORATIVE ROBOT MARKET SIZE FOR FOOD & BEVERAGES INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

TABLE 188 COLLABORATIVE ROBOT MARKET SIZE FOR FOOD & BEVERAGES INDUSTRY, BY REGION, 2021–2027 (USD MILLION)

12.4.6 FURNITURE & EQUIPMENT

12.4.6.1 Collaborative robots are used to perform various pick-and-place and machine tending applications

TABLE 189 COLLABORATIVE ROBOT MARKET SIZE FOR FURNITURE & EQUIPMENT INDUSTRY, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 190 COLLABORATIVE ROBOT MARKET SIZE FOR FURNITURE & EQUIPMENT INDUSTRY, BY REGION, 2021–2027 (USD THOUSAND)

12.4.7 HEALTHCARE

12.4.7.1 Collaborative robots are deployed for non-surgical applications in healthcare industry

TABLE 191 COLLABORATIVE ROBOT MARKET SIZE FOR HEALTHCARE INDUSTRY, BY REGION, 2017–2020 (USD THOUSAND)

TABLE 192 COLLABORATIVE ROBOT MARKET SIZE FOR HEALTHCARE INDUSTRY, BY REGION, 2021–2027 (USD THOUSAND)

12.4.8 OTHERS

TABLE 193 COLLABORATIVE ROBOT MARKET SIZE FOR OTHER INDUSTRIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 194 COLLABORATIVE ROBOT MARKET SIZE FOR OTHER INDUSTRIES, BY REGION, 2021–2027 (USD MILLION)

13 APPENDIX (Page No. - 216)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

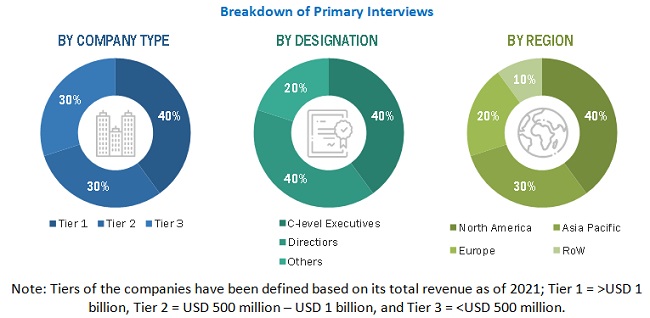

The study involved four major activities in estimating the current size of the educational robot market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the educational robot market.

Secondary Research

Secondary sources referred for this study include company websites, magazines, industry news, associations (Robotic Industries Association (RIA), Robotics Society of Japan, IEEE Robotics and Automation Society, Association for Unmanned Vehicle Systems International (AUVSI), others), and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, trade, and databases. The secondary data has been collected and analyzed to arrive at the overall educational robot market size, which is further validated by primary research.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the present scenario of the educational robot market through secondary research. Several primary interviews have been conducted with market experts from both the demand (adopters of robots used for educational applications) and supply (educational robot manufacturers and distributors) sides across 4 key regions, namely, North America, Europe, Asia Pacific, and Rest of the World. Approximately 25% and 75% of the primary interviews have been conducted with parties from the demand and supply sides, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

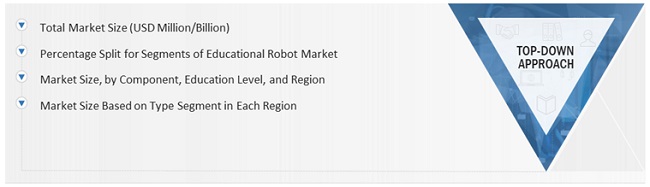

Market Size Estimation

In the complete market engineering process, both the top-down and bottom-up approaches, along with several data triangulation methods, have been used to estimate and validate the size of the educational robot market and other dependent submarkets. The key players in the market have been determined through primary and secondary research. This entire research methodology involves the study of the annual and financial reports of the top market players and extensive interviews with industry experts, such as CEOs, vice presidents, directors, and marketing executives, for both qualitative and quantitative key insights related to the educational robot market.

- In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research.

- For the calculation of sizes of segments of the educational robot market, the market size obtained by implementing the bottom-up approach has been used in the top-down approach. This has been later confirmed with primary respondents across different geographies.

- The bottom-up approach has also been implemented for the data extracted from secondary research to validate the size of various market segments.

- The market share of each company has been estimated to verify revenue shares used in the bottom-up approach earlier.

- The sizes of the overall parent markets (industrial robotics market and service robotics) and each individual market have been determined and confirmed in this study with the help of a data triangulation procedure and validation of data through primary interviews.

Global Educational Robot Market Size: Top-down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the educational robot market size, by type, component, and education level, in terms of value

- To describe and forecast the educational robot market size, by type and education level, in terms of volume,

- To describe and forecast the educational robot market size, in terms of value and volume, with respect to four main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the educational robot market

- To provide a detailed overview of the supply chain of the educational robot ecosystem

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To benchmark the market players using the proprietary, company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of business strategy excellence and strength of product portfolios

- To analyze competitive developments, such as acquisitions, product launches, partnerships, expansions, and collaborations, undertaken in the educational robot market

Available Customizations:

MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

- Additional country level analysis of educational robot market

- Detailed analysis and profiling of additional market players (up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Educational Robot Market

We are submitting a research project to exploit robotics in handwriting and music education and we would like to identify the impact of the proposal.

My client is a Chinese supplier of robotics kits for children to learn how to Programme and build robotics. They want to find out about the market analysts to ensure they get included in the research. Is this you?

I would like to get insights on the market penetration of robots in early education.

I'm working on a short PPT (for personal use) and need several parts of your report. May I ask for a discount of this report?

We are working and developing a new project related AI home-schooling crossing data from home-schooling and teaching robots. Is your report helpful for us?

We are preparing for a pitch where knowing the market size and potential is important. Your report can help a great deal!

We want to understand more about global market trends of robot in educational area, and its breakdown by region/countries.